- GOLD - $2,371.45

- SILVER - $28.00

- PLATINUM - $948.88

- PALLADIUM - $977.00

- GOLD - $2,371.45

- SILVER - $28.00

- PLATINUM - $948.88

- PALLADIUM - $977.00

- GOLD - $2,371.45

- SILVER - $28.00

- PLATINUM - $948.88

- PALLADIUM - $977.00

Our Gold and Silver Products

See all

Gold

Silver

Simplifying Your Path to Wealth Diversification

At Newport Gold Group, we simplify the process of investing in precious metals, making it accessible for everyone, whether you’re a beginner or a seasoned investor looking to broaden your portfolio. Our extensive selection of gold bars and coins is tailored to align with your personal investment goals. Diversifying your wealth doesn’t have to feel overwhelming when you have the right support.

Frequently Asked

Questions About Gold

How can I buy gold?

Newport Gold Group makes buying gold coins effortless, offering a wide selection for you to explore and flexible payment options such as checks, bank wire transfers, or retirement account rollovers. Simply contact a representative by phone to place your order, and decide whether you’d prefer to have your coins delivered to your doorstep or safely held in a retirement plan, tailored to your needs.

Why should I buy gold?

For centuries, gold has been a cornerstone of stability, consistently holding its value through economic ups and downs. It offers protection during inflation and currency shifts, making it a trusted choice for investors seeking to diversify. When stock markets experience volatility, gold often provides a counterbalance, acting as a protective shield for your investments. At Newport Gold Group, our experienced brokers, with years of expertise from top firms, guide you in leveraging gold’s enduring strength to secure your financial future.

If gold is gold, why does it matter if I buy a coin or a bar?

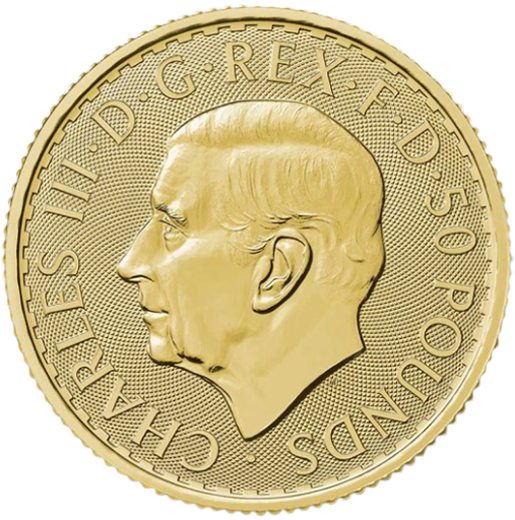

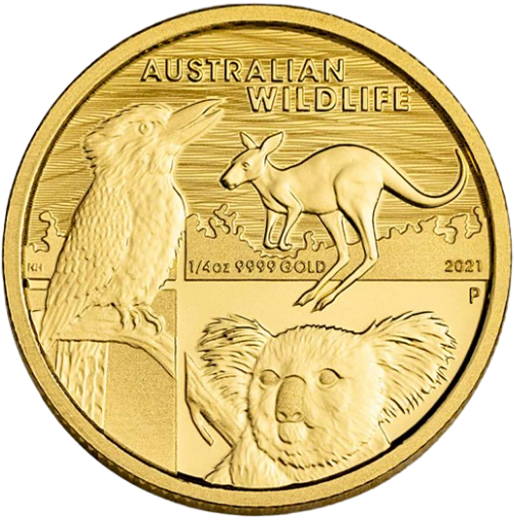

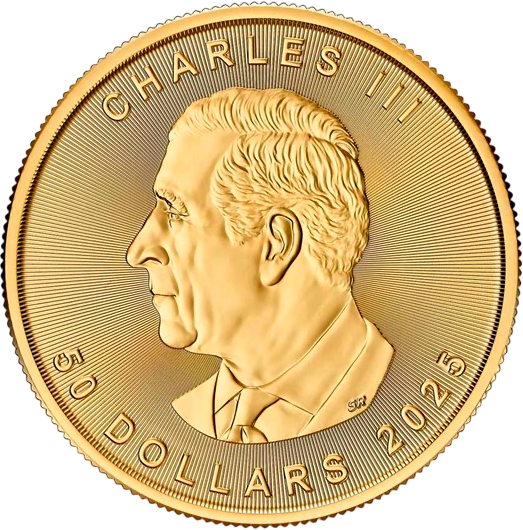

A popular way to invest in physical gold is through gold coins, which are crafted by government mints around the world. These coins are available in a variety of sizes and designs, each offering its own distinct appeal and value, making them suitable for a wide range of investors and collectors.

Many gold coins are recognized as legal tender in their countries of origin, carrying a nominal face value. However, their true worth typically far exceeds this amount, driven by the value of the gold they contain. This combination of historical craftsmanship and intrinsic value makes gold coins an attractive option for those looking to diversify their investments or build a meaningful collection.

Gold bars, crafted by both government and private mints worldwide, provide a practical and cost-effective way to invest in gold, often featuring lower premiums than coins due to their focus on purity and weight rather than artistic design. Available in sizes ranging from one gram to a kilogram, they suit a variety of investors, whether you’re starting with a modest purchase or seeking larger quantities, some of these bars come with a certificate verifying its authenticity, weight, and purity. This combination of simplicity, efficiency, and versatility makes gold bars a simple choice for those looking to diversify their investments with a straightforward asset.

Many gold coins are recognized as legal tender in their countries of origin, carrying a nominal face value. However, their true worth typically far exceeds this amount, driven by the value of the gold they contain. This combination of historical craftsmanship and intrinsic value makes gold coins an attractive option for those looking to diversify their investments or build a meaningful collection.

Gold bars, crafted by both government and private mints worldwide, provide a practical and cost-effective way to invest in gold, often featuring lower premiums than coins due to their focus on purity and weight rather than artistic design. Available in sizes ranging from one gram to a kilogram, they suit a variety of investors, whether you’re starting with a modest purchase or seeking larger quantities, some of these bars come with a certificate verifying its authenticity, weight, and purity. This combination of simplicity, efficiency, and versatility makes gold bars a simple choice for those looking to diversify their investments with a straightforward asset.

Where can I store my Gold?

You can store your gold in a professional third-party facility for enhanced security and peace of mind, or keep it at home if you prefer easy access. When storing at home, ensure safety by using a secure safe or vault, and check your home insurance policy, as coverage for precious metals may require additional protection.

How do I sell my gold?

To sell your gold, start by finding a reputable buyer, such as a trusted dealer like Newport Gold Group, or explore markets where gold often attracts competitive offers due to its widespread appeal. The process is straightforward since gold’s universal value draws a broad pool of buyers, allowing you to convert it into cash quickly and efficiently whenever you need.

Frequently Asked

Questions About Silver

Why is silver considered a good purchase?

Silver is valued for its potential to hedge against inflation and its demand in technologies like solar panels and electronics. It may diversify portfolios and act as a safe-haven, though losses are possible due to price volatility.

How does silver compare to gold?

Silver is more affordable than gold, allowing larger purchases for less. Both are precious metals, but silver’s industrial uses provide unique demand, though prices can fluctuate.

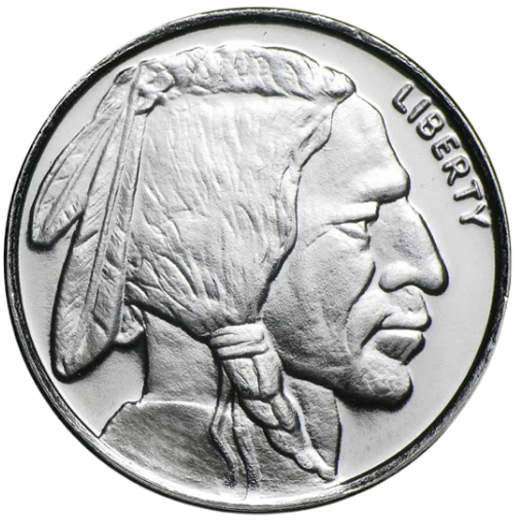

How do I choose between silver coins, bars, or rounds?

Silver coins, like American Eagles and Canadian Maple Leafs from government mints, are valued for their silver content and collectible designs, though prices may vary. Bars, mostly from private mints, are cost-effective, focusing on purity. Rounds, from private mints, are budget-friendly, less standardized, and market-sensitive. Buy from reputable dealers like Newport Gold Group, your trusted source, to ensure quality, as premiums and volatility affect value.

Can I buy silver through a retirement account?

Certain retirement accounts, like self-directed IRAs, allow you to buy physical silver, but strict IRS rules apply. Only specific forms (e.g., high-purity bullion) qualify, and you’ll need a custodian. This involves fees, storage, market, and liquidity risks, so consult a financial advisor for compliance.

Most Recent News

21 November, 2025

Daily Gold Market Update

Daily Gold Market Update Markets Fall Hard Yesterday – Gold Stays Strong Yesterday was another rough session on Wall Street.The major indexes closed sharply lower...

Read More

19 July, 2024

Gold’s Golden Moment: Why the Dollar’s Decline Fuels a Precious Metal Surge

Gold’s Golden Moment: Why the Dollar’s Decline Fuels a Precious Metal Surge The U.S. dollar has dropped nearly 10% against major currencies since January 2025,...

Read More